proposed federal estate tax changes 2021

Increase the corporate income tax rate from 21 to 28. The exemption was indexed for inflation and as of 2021 currently stands at 117 million per person.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

In addition the proposed bill.

. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. On September 27 2021 the Build Back Better Act was introduced into the House of Representatives as. The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but that is currently set to expire on Dec.

Current Estate Tax in 2021 Proposed Changes. The current estate tax exclusion for an individual is 117 million effectively 234 million for married couples. A person can currently transfer up to 117 million of assets at death without incurring any Federal Estate Tax.

The estate tax ranges from 18-40. However the revised proposals have eliminated this early sunset so if enacted the higher exemption would remain available through. The exemption is the.

That is only four years away and Congress could still. 31 2025 and decrease to approximately 55 million per person. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation.

In 2021 the threshold for federal estate taxes is 117 million which is slightly up from the 1158 million in 2020. The Biden administration proposals must first be approved by Congress. Currently for the 2021 tax year the federal estate tax applies to assets greater than 117 million per person and 234 million for married couples.

The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for inflation beginning January 1 2022. The Biden Administrations proposed changes if approved could have a significant impact on estate taxes gift exemptions and overall estate planning. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

The maximum estate tax rate would increase from 39 to 65. Estate gift and GST tax exemptions will remain at 117 million with increases allowed for inflation in 2022-2025. It is predicted that Congress will pass new tax legislation in the next few years that.

Estate and Gift Tax Exemptions The Biden framework does not include lowering the current estate gift and generation skipping transfer GST tax exemptions before the previously scheduled sunset date of December 31 2025. Proposed Changes to Federal Estate Tax. In the area of estate and gift taxation there are proposals to reduce the lifetime exemption for transfers by gift or death.

In addition the proposed bill provides that estates or trusts with income over 100000 would be subject to an additional 3 tax on their modified adjusted gross income. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals.

Under the current proposal the estate. Reduce the current 117 million federal ESTATE tax exemption to 35 million. Meaning estates under 1158 millionpossibly a LOT less than 1158 millioncould be subject to these taxes.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. The Biden Administration has proposed significant changes to the income tax system. For married couples this threshold is doubled meaning they can protect up to 234 million in 2021.

However under the legislative proposals. The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married couple from estate tax. 10 on assets 18 on property.

The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Many states have much lower levels and cause sizable State inheritance taxes.

Here is what we know thats proposed. For the vast majority of Americans the federal estate tax the death tax has been a non-issue since 2010 when the exemption was raised to 5 million and indexed for inflation. New leadership has proposed decreasing the current tax exemption.

A persons gross taxable estate includes the value of all assets including even proceeds. Thankfully under the current proposal the estate tax remains at a flat rate of 40. The current 2021 gift and estate tax exemption is 117 million for each US.

Here are some of the possible changes that could take place if Sanders proposed tax changes become law. Read on for five of the most significant proposed changes. The exemption is the.

Proposals to decrease lifetime gifting allowance to as low as 1000000. A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal. Impose a minimum 15 corporate income tax on the book earnings of large corporations.

Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. The exemption equivalent was significantly raised beginning January 1 2018 and the inflation adjusted amount for the 2021 year is 11700000. The exemption equivalent that was increased beginning January 1 2018 is.

Current Transfer Tax Laws. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. Capital gains tax would be increased from 20 to 396 for all income over 1000000.

So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms would be subject to both. Decreased Estate Tax Exclusion. As Congress is now considering these tax law change proposals the following is a summary of some of the most important.

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

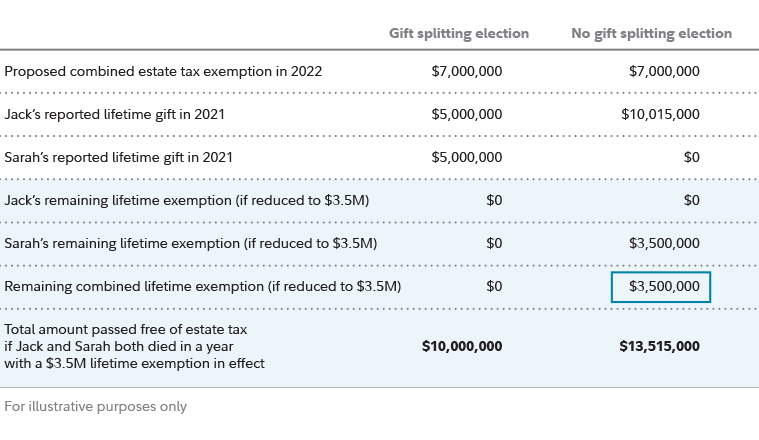

Estate Planning Strategies For Gift Splitting Fidelity

Estate Tax Law Changes What To Do Now

Estate Tax Definition Federal Estate Tax Taxedu

It May Be Time To Start Worrying About The Estate Tax The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Biden Greenbook Estate Tax Proposals Should You Care

It May Be Time To Start Worrying About The Estate Tax The New York Times

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How The Tcja Tax Law Affects Your Personal Finances

New Estate And Gift Tax Laws For 2022 Youtube

Irs Announces Higher Estate And Gift Tax Limits For 2020

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition